News From Solareum

Search From Blog

Hello, Solareum Community!

As we approach the mainnet launch of our revolutionary Layer 1 blockchain, it’s time to revisit one of the most transformative updates in our ecosystem—our transition from a single token, SRM, to the dual-token system of SLM and JUL. This change reflects both the evolution of our vision and our dedication to creating a sustainable, user-centric blockchain economy.

The decision to transition to a dual-token structure emerged as a pivotal moment in our journey to build a more versatile and sustainable blockchain ecosystem. It stemmed from months of development, analysis, and feedback, all with the aim of designing a system that could seamlessly integrate blockchain technology with renewable energy production. With this new approach, SLM and JUL have become the foundation of Solareum’s mission, each playing a pivotal role in our ecosystem's functionality and sustainability.

A Recap: What Led to SLM and JUL

Originally, Solareum’s ecosystem was powered by the SRM token. While it served us well in the early stages, our ambition to create a truly innovative blockchain required a more dynamic and flexible framework. Enter the dual-token system, a solution that not only preserves but enhances the core principles of our platform.

With the introduction of SLM, we established a fixed-supply token designed to act as a store of value, ensuring stability and long-term growth. JUL, on the other hand, serves as the operational gas token, enabling transactions, smart contract execution, and powering the Solareum blockchain. Together, these tokens form a harmonious system that combines financial sustainability with utility, offering a balance that SRM alone could not achieve.

The transition to SLM and JUL also brought clarity to our ecosystem. This shift represents a foundational improvement in how our ecosystem functions. By introducing SLM and JUL, we’ve built a system that ensures stability while optimizing operational efficiency, positioning Solareum to drive adoption and make a tangible impact in the renewable energy sector.

Understanding the Ecosystem: How SLM and JUL Work Together

At the heart of Solareum’s ecosystem stands the interaction between SLM and JUL. This dynamic duo is designed to incentivize active participation while fostering both financial and environmental benefits.

Users who generate renewable energy through GEM devices earn JUL as a reward. This gas token powers all blockchain transactions and smart contracts. However, the process begins with SLM, which users must hold to mint JUL. This mechanism creates a natural cycle: holding SLM generates JUL, which is used for operations, and the rewards cycle back as SLM, ensuring a constant demand for the limited-supply token.

This dual-token system not only simplifies the user experience but also offers an environmentally conscious alternative to traditional blockchain models. It ensures that energy producers, from individual households to large solar farms, are rewarded fairly while contributing to a sustainable and decentralized network.

The Role of PoG and Elastic Token Model

Proof of Generation (PoG) is the cornerstone of Solareum’s validation mechanism. By tying blockchain security to real-time energy production data, PoG eliminates the inefficiencies of traditional models like Proof of Work and Proof of Stake. Instead, it leverages GEM devices to monitor, validate, and record renewable electricity generation directly on-chain through this process, ensuring transparency and driving renewable energy adoption.

The Elastic Token Model complements PoG by linking supply expansion directly to renewable energy production milestones. Think of it as a dynamic progress bar: as GEM devices validate and log green energy production, the "progress bar" steadily advances. When a specific milestone is achieved, a designated period begins, unlocking a new portion of the total supply, which is gradually added to block rewards. Once these milestones are met, Proof of Hold (PoH) will also be activated, allowing SLM holders to earn block rewards alongside validators.

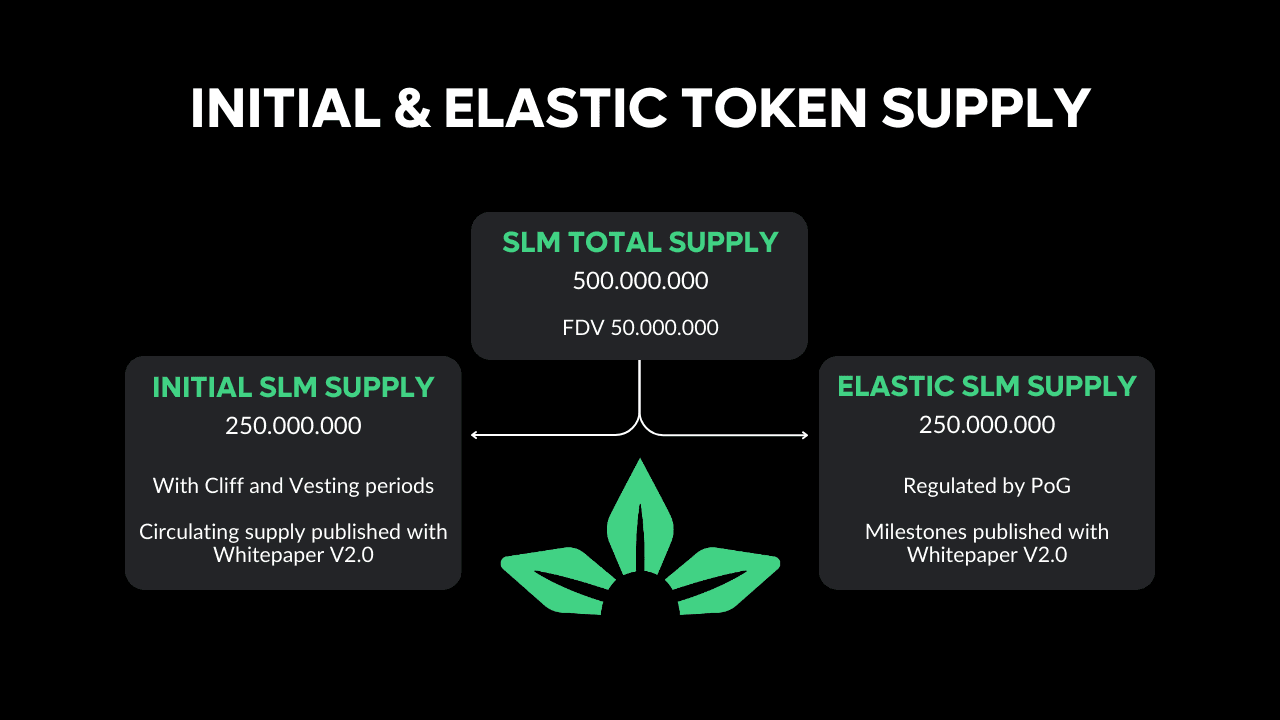

Our total supply of SLM is fixed at 500,000,000 and divided into two key segments:

250,000,000 SLM will be active at the mainnet launch, governed by cliff and vesting periods.

250,000,000 SLM will be regulated by the Elastic Token Model (milestones), unlocked incrementally based on renewable energy production milestones validated through PoG.

The exact milestones and formulas for unlocking the remaining supply will be detailed in Whitepaper V2. Based on our calculations, we expect these milestones to occur approximately yearly, although this timeline is subject to real-world energy production and validation rates.

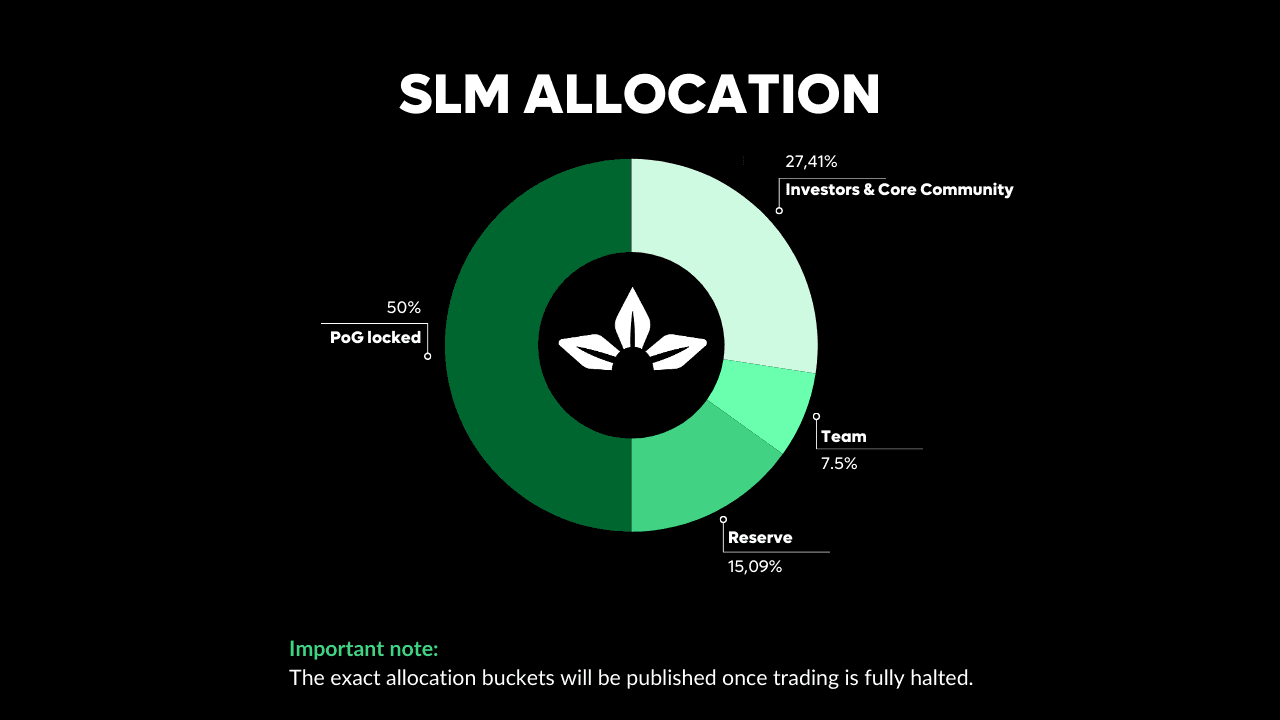

SLM Allocation

(Exact values will be published in Whitepaper V2 after pause trading):

27.41% - Investors & Core Community

7.5% - Team Allocation

15.09% - Reserve for Ecosystem Needs

50% - Locked for Proof of Generation (PoG), gradually unlocked through renewable energy milestones

The complete allocation breakdown will be published after trading is fully halted to maintain stability and avoid shifts between migrating users and other categories. Whitepaper V2.0 will include comprehensive details on tokenomics, covering sub-buckets such as the Solareum Foundation, Solareum Grants, investor allocations, reserves, and validator rewards. It will also outline specific vesting schedules and cliff rates, ensuring full transparency.

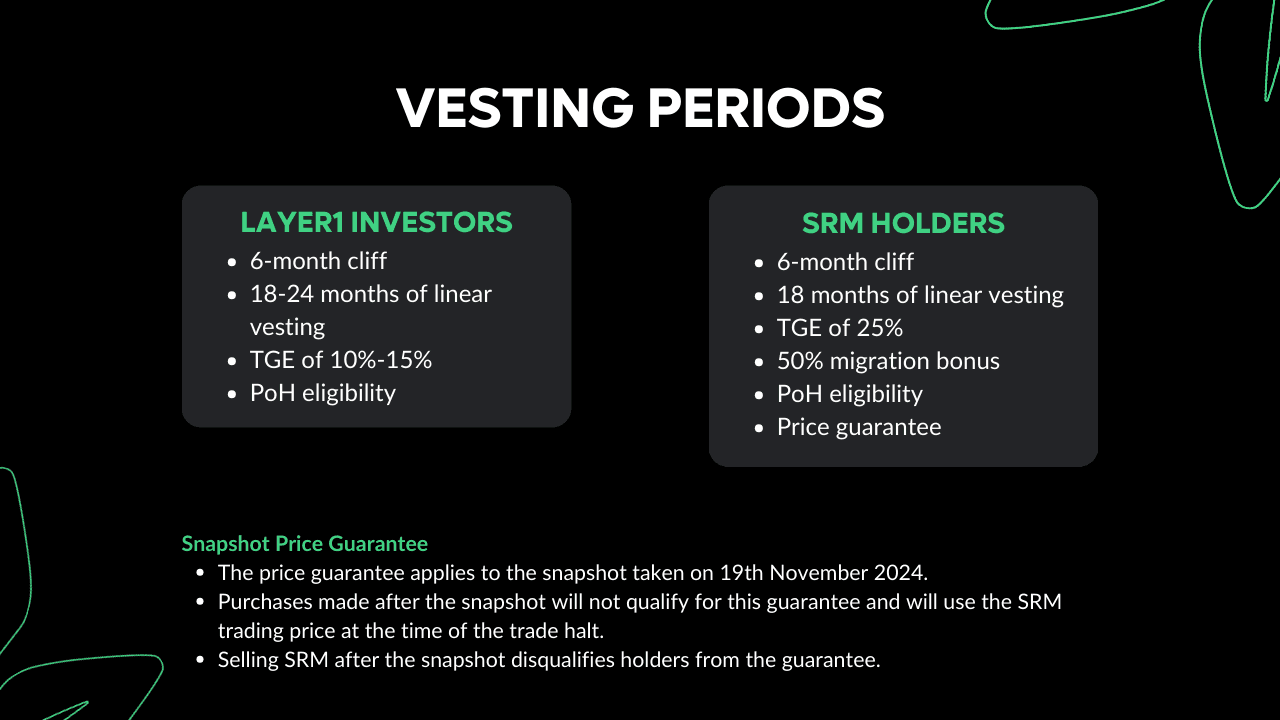

Vesting and Sustainable Launch of Solareum’s Layer 1

Launching a sustainable Layer 1 blockchain requires a delicate balance of token distribution and ecosystem protection. To ensure stability, we’ve implemented a comprehensive vesting structure in the Solareum ecosystem.

For Layer 1 investors, tokens will be vested with a 6-month cliff followed by 18-24 months of linear vesting, with a TGE of 10%-15%.

Migration and Vesting for Current Community

We’ve also determined that existing SRM token holders migrating to SLM will participate in a locking period to maintain consistency within the ecosystem. This structure protects our ecosystem, minimizes immediate supply shocks, and safeguards the JUL production mechanism, which relies on holding SLM. Additionally, this approach reflects discussions with investors and addresses the current impact of having an actively traded token, ensuring long-term stability and sustainability.

At launch, 25% of the total value of migrated tokens will be unlocked at TGE. The remaining balance will be subject to a 6-month cliff, followed by an 18-month linear vesting schedule.

To illustrate, here’s an example calculation:

SRM Value: $1,000

Migration Bonus: 50% (adding $500), bringing the total to $1,500 in SLM value.

TGE: 25% of $1,500 = $375 unlocked at launch.

PoH Eligibility: The full $1,500 is eligible to produce JUL immediately.

Additionally, we’ve taken a snapshot of the SRM price ($0.0366 - 1 hour before this blog’s release) to establish a guaranteed ground floor. If the price drops below this snapshot value, all holders who owned SRM at the time of the snapshot will have their migration value calculated based on this guaranteed price.

Important Notes: Purchases made after the snapshot will not be eligible for this guarantee and will be converted based on the actual SRM trading price at the time of the trading halt. Additionally, selling SRM after the snapshot will disqualify holders from this guarantee.

Mainnet Preparation

To streamline the transition to mainnet and ensure a fair and sustainable token allocation, trading of SRM will be halted two weeks from today, on 3rd December at 5 PM EST. This will allow us to finalize allocations, prevent market disruptions, and prepare the ecosystem for launch.

Following this period, we will publish Whitepaper V2, detailing the exact tokenomics and allocations for the mainnet. This pause ensures that potential trading fluctuations will not influence the SLM token during the transition.

What’s Next?

We’re entering a pivotal moment in Solareum’s journey, and the upcoming weeks will bring exciting updates, including:

Whitepaper V2.0

Introductions to new team members

Mainnet Launch Date